are delinquent taxes public record

An owner whose property is subject. A tax lien is a legal claim against real property for unpaid municipal charges such as property taxes housing maintenance water sewer demolition etc.

Gloucester City Tax Sale Information Gloucester City Nj

Property taxes not paid to the.

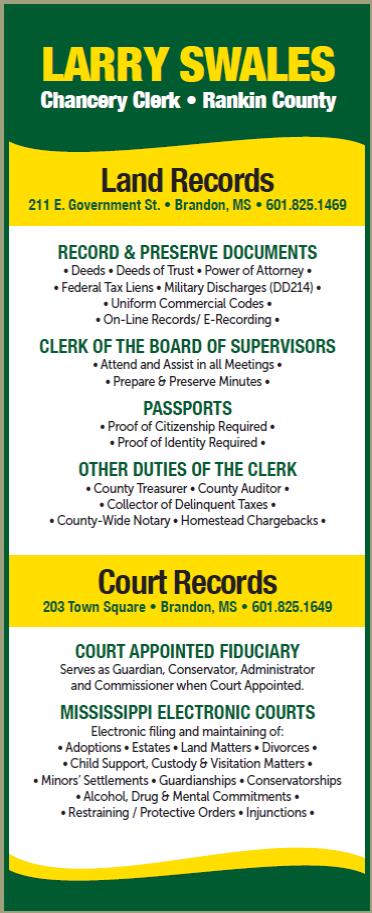

. Seizes property for non-payment in. Certain Tax Records are considered public record which means they are available to the. The list includes taxpayers who have unsatisfied tax warrants or liens totaling 100000 or more.

Delinquent tax records are handled differently by state. ALL PERSONS WITH A LEGAL INTEREST IN THE PARCELS OF REAL. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000.

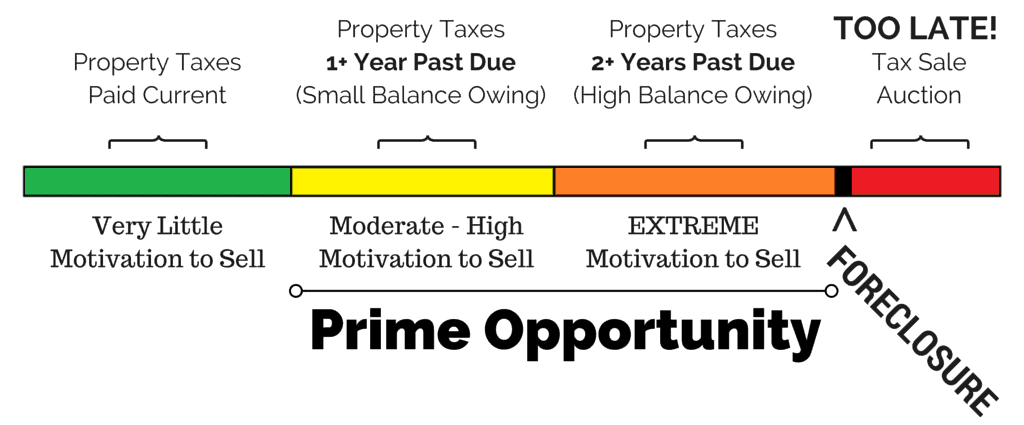

We may have filed the. When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions.

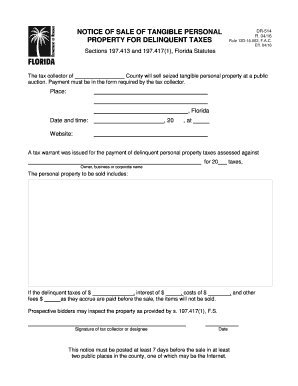

The tax certificates face amount consists of the sum of the following. NOTICE OF DELINQUENT TAXES State of Minnesota District CourtCounty of Steele 3rd Judicial District TO. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount.

455 Hoes Lane Piscataway NJ 08854 Phone. Tax Records include property tax assessments property appraisals and income tax records. Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on.

Real estate taxes fund local services such as public education police protection and medical services. Access to Public Records Public records access is a part of Westmoreland Countys ongoing effort to provide easy and enhanced delivery of county information and services. New York State delinquent taxpayers.

Have not paid their taxes for at least 6 months from the day their. Typically a tax lien is placed on the property by the government when the owner fails to pay the property. Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants.

Delinquent Property Tax Search When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with. In counties where no taxpayer has warrants or liens totaling 100000 the two taxpayers with. Delinquent tax roll tax delinquent list tax forfeiture list Certain tax records are considered public record which means they are available to the public.

The Delinquent Tax office investigates and collects delinquent real property taxes penalties and levy costs. Return to the IRS Data Book home page. Finds and notifies taxpayers of taxes owed.

Page Last Reviewed or Updated. Delinquent property taxes create a serious cash-flow problem for Middlesex County. The Wayne County Treasurers Office is responsible for collecting delinquent taxes on Real Property located within Wayne County.

The Tax Office accepts full and partial payment of property taxes online.

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Treasurer S Office Westmoreland County

Federal Tax Lien Statute Of Limitations 101 Credit Com

Tax Lien Certificates Vs Tax Deeds What S The Difference Proplogix

Notice Of Sale Of Tangible Personal Property For Delinquent Taxes Fill Out And Sign Printable Pdf Template Signnow

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

West Virginia Foreclosures And Tax Lien Sales Search Directory

How Lenders Can Avoid Losing Their Collateral By Paying Off The Borrower S Property Tax Obligations

Chancery Clerk Rankin County Mississippi

How To Find Tax Delinquent Properties In Your Area Rethority

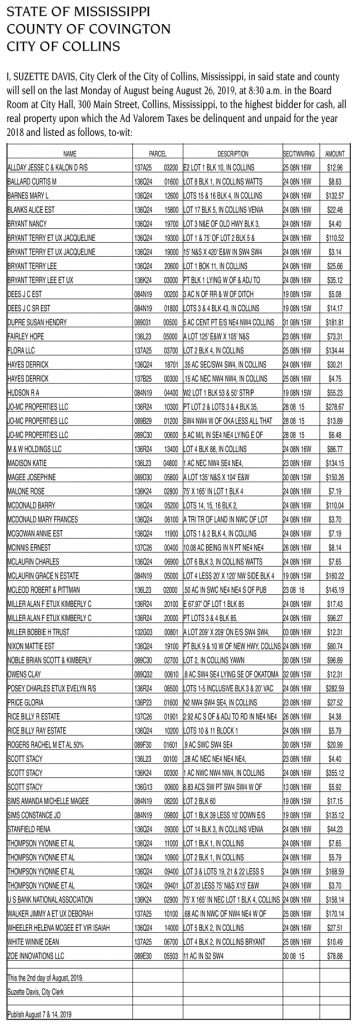

Properties Delinquent In Taxes To Be Sold At Auction City Of Collins

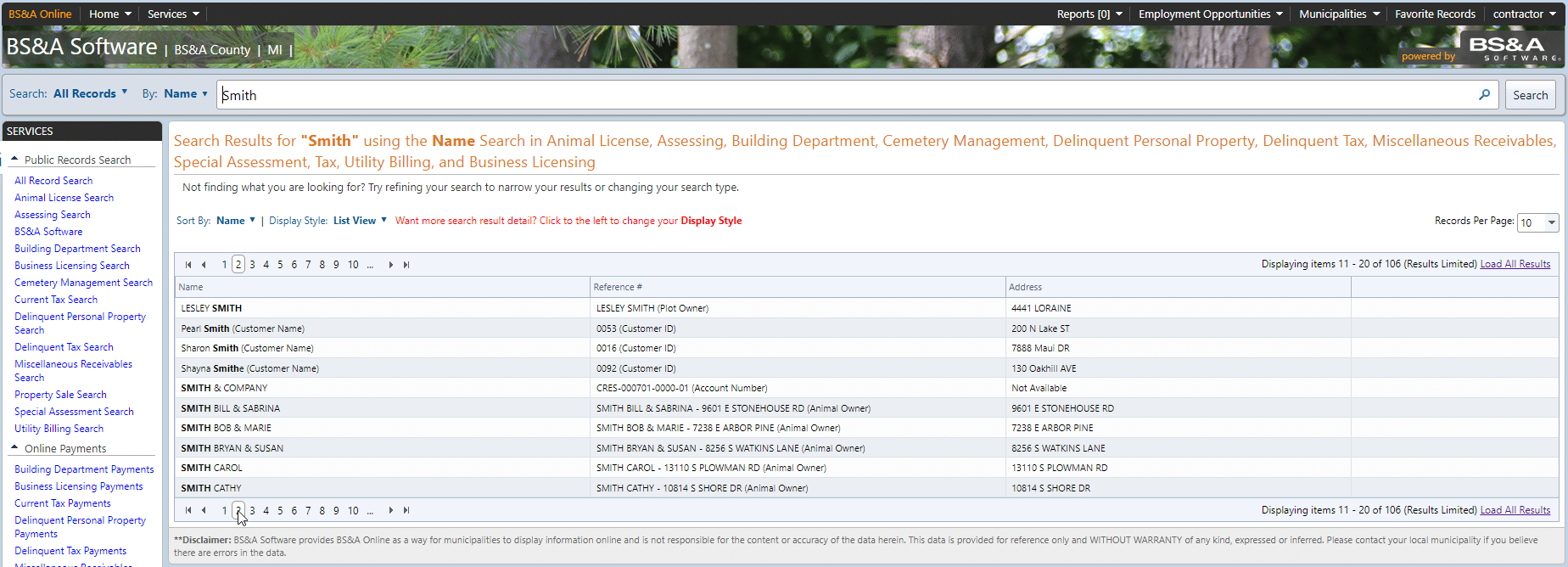

Bs A Online Services Public Records Search Bs A Software

Real Estate Property Tax Jackson County Mo

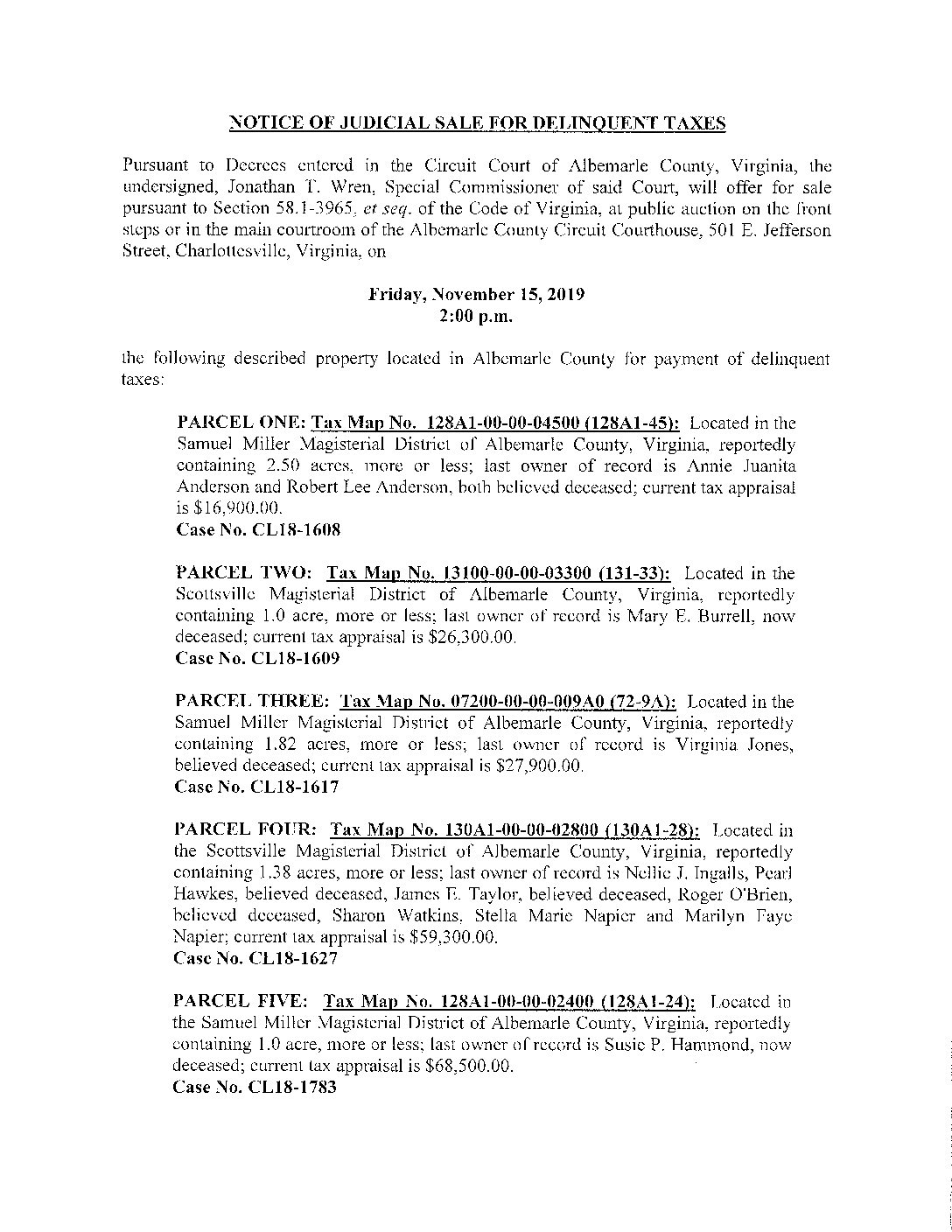

Notice Of Judicial Sale For Delinquent Taxes Virginia Tax Planning Lawyers

Delinquent Taxes May 12 2022 Click To Download Pages Public Notices Hannapub Com